Every nurse needs to create a new identity for themselves. Let’s break up the word, ID-entity, and it’s an entity you use to identify yourself. It’s a legal structure that can be used to protect yourself from liability like lawsuits, or people trying to get your hard earned money. There are so many benefits for starting one. As a matter of fact, I started several LLCs and organized them in a way to protect my bitcoin assets. Like some kind of psychiatric patient with split personalities, you can divide your identity legally and separate your financial life into neat little Oompa Loompas that you control. We won’t get into that much detail here but I wanted to share the single greatest way you can leap into the business world without breaking a sweat and save you a ton in taxes. Let’s go.

The Service: American Heart Association BLS Instructor

First of all, who the hell holds their phone like that? Anyway, if you have not taken an American Heart Association (AHA) Basic Life Support (BLS) CPR class, stop reading now. If you have experienced the mundane and repetitive sequence of BLS at least a few times, then keep reading. Depending on your location, this course is a requirement for all healthcare professionals in every facility in the state. Instant market. The AHA has setup a complete business system with a startup cost of virtually nothing. This is similar to buying into a franchise. You have to get certified as a BLS instructor, you align yourself with a training center, and boom they allow you to purchase the BLS certification ecards to email to your students. You just to follow all the rules of the franchise. If you work in healthcare, buy someone a round of drinks or do it for free for your first customers. The point is that you just need to get started. And we’ll go into all the magical things you can buy for your business, write-offs and pay less in taxes. Keep in mind this post is for information and empowerment purposes only and this is not financial advice, always a consult a licensed professional before attempting any random things you find on the internet.

The Business: It’s Not Complicated. Follow These 3 Simple Steps:

All the checkboxes are hyperlinked if you just want to click to go to that page. So all in all, it’s $365 to start an LLC in CA, $400 for a local training center’s BLS instructor course, and $140 for the BLS Instructor Package. So you’re looking at $905 to get started. This may seem like a lot but bear with me here, it’ll all be worth it in the end. Why? Because we deduct the entire startup cost up to $5,000 as a sweet write-off that will lower your taxes by $1,000-$2500 depending on your tax bracket. It pays itself back. Let’s continue.

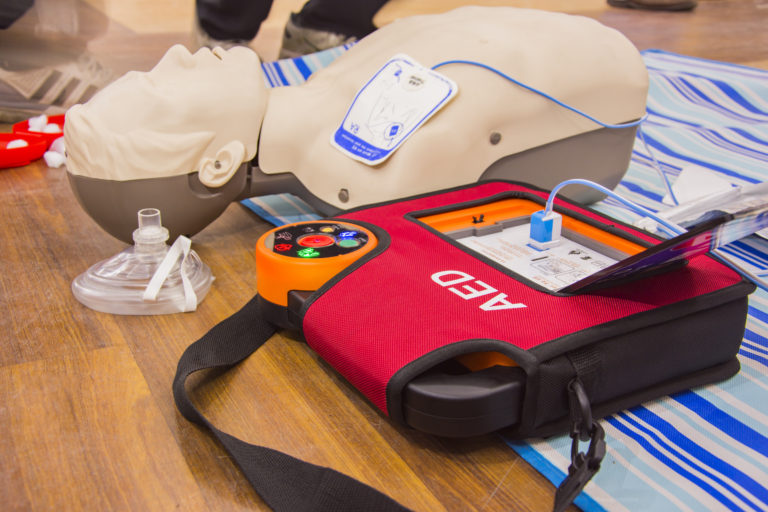

The Equipment: Do Not Buy What You Can Borrow

The equipment you need is very basic. You only need 3 things to do a BLS class. This is from personal and tried experience so trust me when I say less is more. The last thing you want is a bunch of crap cluttering up your home that everyone says you need but you don’t. Here are the essentials all available on Amazon Prime hyperlinked below:

If you can borrow these, that’s a better way to start. When you’re ready to make an investment here are my tips. I opted for the dark skin manikins because these things get dirty and it’s more forgiving when tarnished. If you want to save $150, you can opt to purchase just the infant and child manikin separately for about $160 each. The child can double as an adult and it’s easier to transport. It helps students that are older or smaller to get the compressions done correctly. Keep in mind that using a child manikin as an adult is an AHA no-no but let’s be real in that the small and elderly are less likely to take the compressor role in a real cardiac arrest. I’m sure if it’s their family, the adrenaline will give them the strength they’ll need when it counts. The BVMs I prefer to use in lieu of giving breaths using a one-way valve. After covid this is not really done in a hospital setting anyway. It demonstrates the BVM skill and you can give tips simultaneously. The AED trainer is simple, easy to use, reuseable, and the pads are replaceable. Overall, the equipment will cost you $581.85 and tax. So this brings our total to $1486.85 or let’s round it off to $1500. 3 simple steps later and a shopping list of 3 items you are officially a business owner, congratulations. The cost comes down to under $1k if you can borrow the equipment, nice!

Tax Tips for the New Rich

The greatest book of all time is Tax-Free Wealth by Tom Wheelwright, CPA. He is one of the rich dad advisors for Robert Kiyosaki, author of Rich Dad Poor Dad. If you don’t like to read then at least get the audiobook and listen to it on your commute. There are so many tips, tricks, and secrets that go beyond this post. Essentially, the key things you want to focus on is your $5,000 for your startup cost in business. Once you get your paperwork back from your registered agent service, you can go open your business checking account and apply for your city’s business license. Specifically, get the home business license. This will enable you to setup a home office and that leads to a nice deduction come tax time. Depending on the square footage dedicated to strictly business, you can deduct the percentage of the square footage of your office to the square footage of your home. This means you can deduct a percentage of the cost of your: rent/mortgage, electricity, internet bill, furniture, equipment, etc. Turbotax has a nice interface to walk you through this and help you decide whether a standard or itemized deduction is better. But wait, there’s more! Now you can deduct anything that relates to your profession. Since maintaining your license is a part of your business to remain a competent instructor, you can now attend those continuing education courses or seminars on a business expense. You can now write off all your renewal fees and membership organization fees. You can write off equipment that you need to teach the class, like a stethoscope, uniform, among other things. Do you homework and look for all the qualified business expenses in the book. This is where you can learn about all the things that can be charged to business. Since an LLC is taxed on the same form as your regular taxes, it’s a no brainer and you can pull money in and out with no issues as long as it’s recorded. Don’t forget to sign up for basic accounting software like Quickbooks, link your accounts, and start categorizing your purchases. If you can get your purchases to fit into the neat categories the IRS likes to see, then it’s probably deductible. Get yourself an open-minded CPA and you’ll be golden. So how does this all work? At the end of the year, let’s say you only had one customer and made $50. So with your startup cost of $5,000 you made negative -$4950 on your business. So when it comes to your w-2 ordinary earned income, you will have reported making $4950 LESS. This means you won’t get taxed on $4950. Let’s say you’re in a 24% tax bracket and that means you take $1188 back from Uncle Sam! That’s $1188 back in your pocket that you will not have to pay the government. All done legally.

Let Your Imagination Run Wild

Once you have your LLC setup, you can do ANYTHING you want with it. Let the AHA stuff be a side hustle you maintain for a couple years and consider doing ACLS & PALS instructor for more income. Don’t stop there. Education is so broad that it encapsulates everything. I have developed training products that I sell to other instructors. Opened an Amazon Seller’s account and began selling things under my LLC’s brand name after designing and trademarking a logo I sketched on a napkin. I experiment with alternative ways to make money and use my LLC to finance the initial investment capital. There’s a WHOLE new world out there. For example, I just completed a video game called Horizon: Forbidden West on PS5. Mind you, I beat the game. I finished the whole storyline and felt happy and sad at the same time. They allow you to continue to play the game after the game is beaten and I saw that my game completion percentage was 55%. What the hell? This means out of all the things I could have done in the game, I only did half. Then I thought, what if life was like that? You grow up, get a job, have kids, buy a house, retire, and die. Life completion: 2%. Like the post title says, an LLC is just short for ‘Little Learning Company’. It’s here where you can get your feet wet and understand all the aspects of business. What it really takes to get ahead and when your big opportunity comes, you’ll be ready for it. Luck is when opportunity meets preparation. I don’t know about you, but I do not intend on being a registered nurse for the rest of my life. I’m looking for ways to pivot out and this is one of the best ways I’ve found so far. I wish I can go into more detail but people’s attention span isn’t what they used to be. With that, I’ll wrap this up and wish you the very best. Get out there and start your LLC.